An open access journal

An open access journal

The analysis of Alibaba Group's future stock price trends and overall status based on the Random Forest mode

Abstract

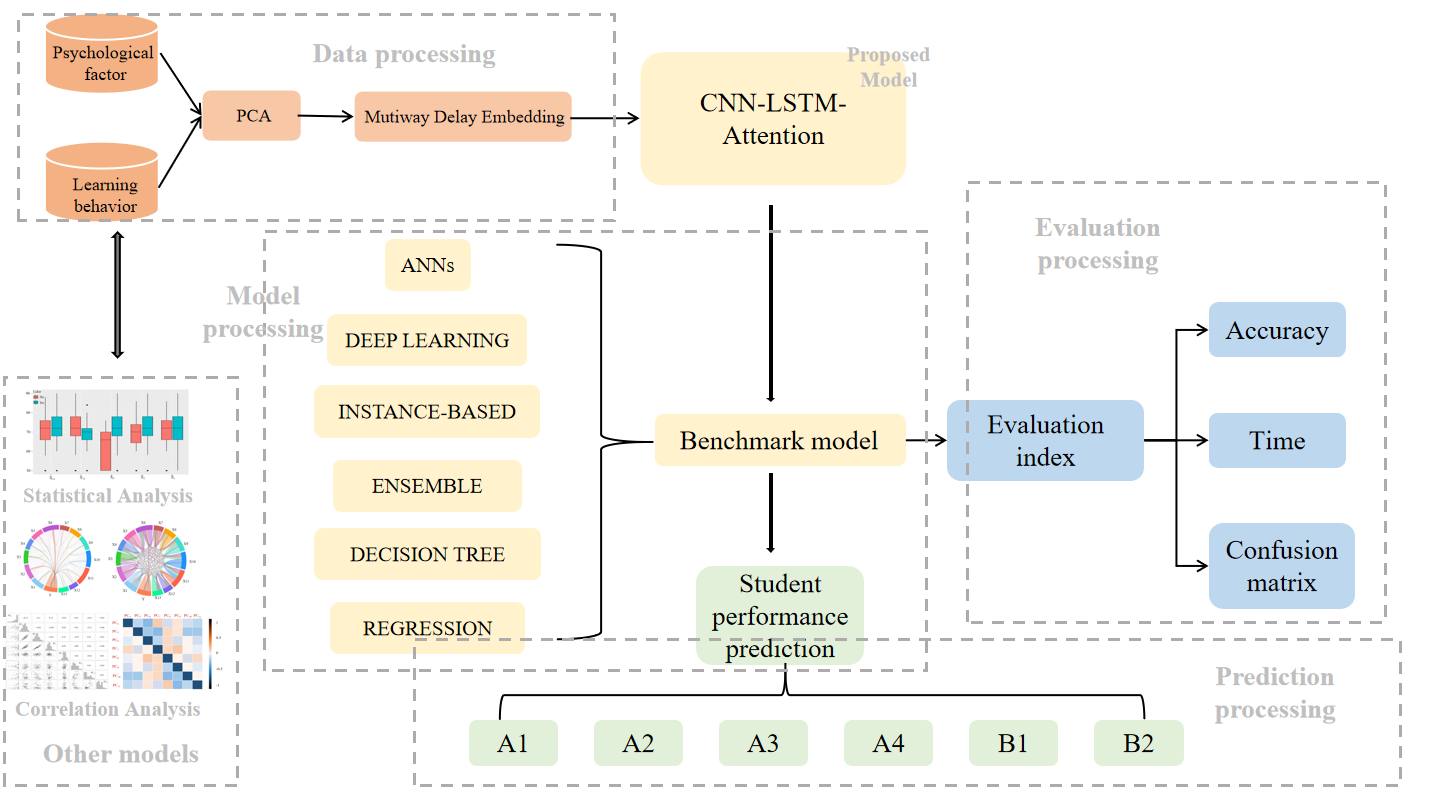

With the rapid development of technology and the ever-changing global landscape, technologies such as cloud computing, artificial intelligence, big data, and blockchain are being widely adopted. E-commerce is rising rapidly, and in today's era, Alibaba Group's overall development trend has gradually heated up after the "1+6+N" business model reform. For investors, stock trend prediction is an important task, but predicting stock price movements is challenging due to the influence of various factors. The Random Forest model is an important technology in the field of artificial intelligence, with significant effectiveness in simulating the specific characteristics of research objects, handling nonlinear problems, and studying non-stationary data. This paper aims to predict Alibaba Group's future development prospects and stock price fluctuations after a series of reforms by constructing a Random Forest model. A multivariate linear regression model is used for numerical analysis, while the model's predictions are systematically scored under the MAE, MSE, MAPE, and RMSE indicators. The accuracy of the Random Forest model in predicting Alibaba Group's future stock price trends is as high as 82.97%.

Share and Cite

Article Metrics

References

- Zou Jie, Li Lu. Based on SA-BiGRU model

- Li Bin. Research on the application of deep learning in the stock price prediction model

- Luckyson Khaidem,Snehanshu Saha,Sudeepa RoyDey.Predicting the direction of stock market prices using random forest

- Cao Yu. Analysis of stock rise and fall prediction model based on dynamic parameter adjustment KNN classification algorithm

- Liu Ye. Building a new business ecology: Alibaba's "1 + 6 + N" organizational reform strategy analysis

- Qian Qimiao, Zhang Duo, Wang Ying, Liu Rui, Cai Feijun. The application of machine learning in stock price forecasting

- Tan Qi, Zhang Xuemei. Research on the path of corporate management change under the background of digital economy

- Chen Zi Zhihai. Stock price forecasting research based on machine learning algorithms

- Han Dongmei, Wang Jin, Gu Yuping. Comparative analysis of the financial strategy matrix under the digital platform business model- -take Jingdong and Alibaba as examples